According to the US Department of Labor, Labor Day is an annual celebration of the social and economic achievements of American workers. The American worker is certainly deserving of recognition and a holiday, but today I want to celebrate the very resilient US labor market. At Gradient Investments, we believe the US consumer is the engine of our economy. Further than that, we believe job and wage growth are the oil that keep that engine running smoothly.

Based on the most recent data for August 2023, jobs increased by 187,000 and US jobs have increased for 32 months straight (the last monthly decline was December of 2020). Despite this growth, the unemployment rate did rise to 3.8% in July. This is still well below long term averages and not far off the 50-year low unemployment rate we have seen recently. The rise in the unemployment rate, despite growth in jobs, was due to rising participation rates in the labor force. Labor participation has been lower than long term averages since the significant decline during the onset of COVID. Since, we have been steadily increasing the participation rate in labor, but that rate still lies well below the peak levels in the late 1990s.

While jobs are important, it is also important for wages to rise to offset the long-term effects of inflation. The August data showed wage gains of 4.3% in August. Wage growth has slowed from recent highs in early 2022 but are still growing. Further, because inflation is easing from the abnormally high levels in 2022, wage growth is actually now higher than headline inflation. This creates more purchasing power for the US consumer.

As with all data, there are good and bad points for adding jobs and growing wages.

- While our belief is that positive jobs data is healthy for the economy, there is a chance that continued job and wage growth reaccelerates inflation.

- If this occurs, the Federal Reserve may have to continue to raise interest rates to combat rising inflation.

- Rising rates could lead to a slowing US economy and also heightens the risks of a recession.

Current job and wage growth has never been a terrific predictor of future recessions, as job loss usually doesn’t occur until we are already in a recession. Therefore, using a healthy job market as the reason for continued economic growth is not necessarily the best metric.

It is our opinion, though, that spending drives our economy, and that spending is tied to the consumer’s thoughts around the job market. If the US consumer believes they are likely to keep their job or can replace a job if needed, that is a tailwind to economic growth and spending. This sentiment can change fast, however, and consumers worried about jobs are more likely to pull back spending. This affects companies reliant on the US consumer and can cascade into further job loss and even greater declines in spending. That is why we welcome jobs and wage growth, even as it slightly increases the potential inconvenience of elevated inflation.

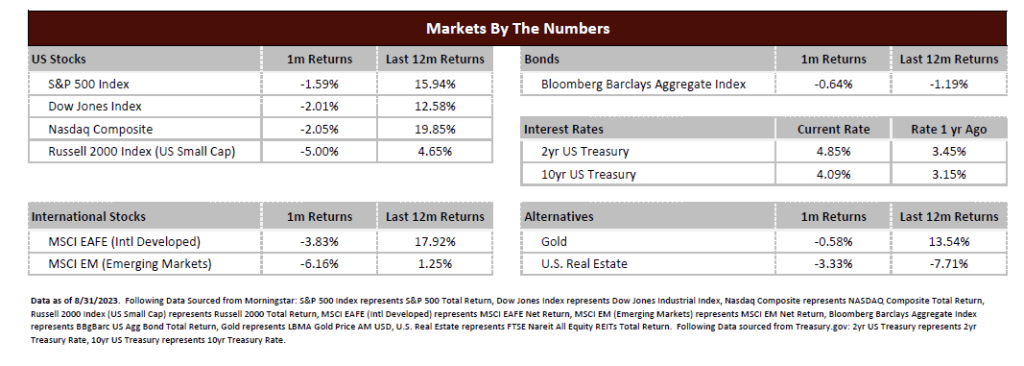

While we believe job growth is healthy for the US economy, it isn’t perfectly correlated with positive market performance. As said, we have grown jobs for 32 months straight, but the market still faced a difficult year in 2022 and we are still below the highs set in January 2022. The bond market also had a very difficult year in 2022 as interest rates rising were a significant headwind to bond prices. Market movements are based on estimates of the future, and the current situation in jobs and wages don’t necessarily correlate with expectations of future growth. Also, a healthy labor market can also have an impact on company earnings. If corporations cannot offset the rising costs of labor through growth or price increases, then earnings may fall below expectations and be a headwind for the market.

In closing, we welcome this Labor Day weekend as a celebration of the US worker. We also welcome job and wage growth for these American workers as it provides more confidence to their spending. However, we can never rely on one metric to tell us how markets will react both now and in the future. While job growth provides a healthy backdrop, jobs don’t tend to revert until we are already facing economic issues and aren’t a great predictor of recessions or market corrections. As a result, we will continue to monitor jobs in conjunction with other economic data trends and communicate any changes in our market outlook.