By Keith Gangl

The first half of 2025 is now in the books, and it proved to be a memorable period for investors. As June ended, the stock market, as represented by the S&P 500, reached record highs, an outcome that seemed improbable just months earlier following an aggressive selloff in April. Despite significant market volatility, driven in part by President Trump’s April 2 tariff announcement, investors have continued to propel the market to unprecedented levels.

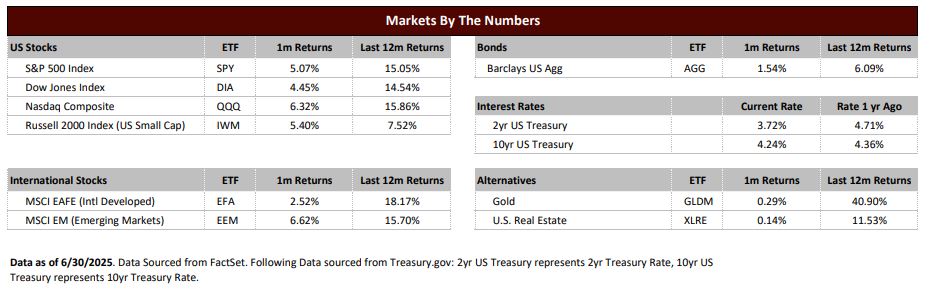

Historically, the S&P 500 has delivered average annual returns exceeding 9% over the past two decades. The index’s 6% gain in the first half of 2025 may appear modest on the surface, suggesting a potentially average year for market returns. However, this seemingly unremarkable performance masks a turbulent journey characterized by April’s sharp decline followed by a remarkable recovery that ultimately established new all-time highs.

Several factors have contributed to this impressive rally. Investors have grown less concerned about potential tariff impacts as initial fears proved overblown. Oil prices declined following the easing of Middle East tensions, while the Federal Reserve signaled future rate cuts, a development typically viewed as a market tailwind. The April 2 tariff announcement initially sparked widespread concern among investors who feared it would disrupt global trade and potentially trigger a recession, prompting significant stock selling. However, as months passed, the tariffs appeared less burdensome than anticipated, and the expected inflation surge failed to materialize to the degree initially feared.

Another significant market catalyst has been the surge of interest in artificial intelligence investments. AI represents a secular growth theme still in its early stages, and investors seeking exposure to this trend have gravitated toward large-cap technology stocks, helping drive overall market gains.

As second quarter earnings announcements unfold over the coming weeks, investors will gain deeper insight into corporate health and the actual impact of tariffs on business operations. The market will closely scrutinize whether companies can maintain profitability despite higher tariff costs or if these additional expenses will erode earnings and constrain economic growth. The sustainability of the positive earnings momentum from the first quarter remains crucial for future market performance. The upcoming earnings season will serve as a crucial litmus test, revealing whether corporate America can deliver the growth necessary to justify current valuations while navigating an increasingly complex global trade environment.

The first half of 2025 serves as a reminder that markets are remarkably adept at climbing walls of worry. While record highs generate headlines and inspire confidence, they also underscore the importance of maintaining a balanced perspective and disciplined investment approach. As we move forward, the market’s ability to sustain this momentum will depend not only on the continuation of current favorable conditions but also on corporate America’s capacity to adapt, innovate, and thrive in an evolving economic landscape. For investors, the lesson remains clear: while celebrating recent gains, preparation for the inevitable challenges ahead will ultimately determine long-term investment success.