By Lisa Schreiber

“Both optimists and pessimists contribute to society. The optimist invents the aeroplane, the pessimist the parachute.”

— George Bernard Shaw

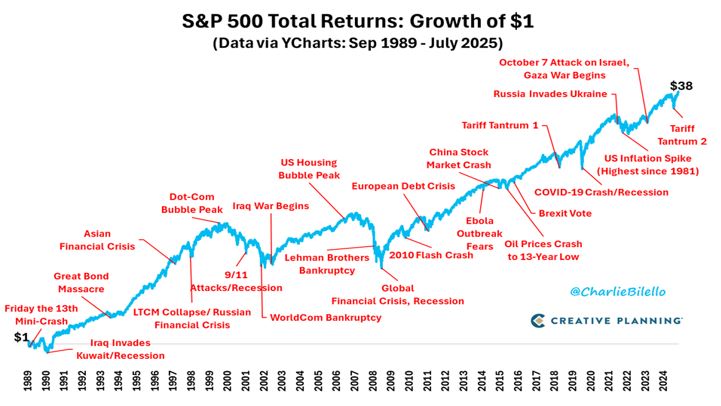

In a market environment often clouded by uncertainty, the optimist’s case offers a compelling counterbalance — a perspective rooted not in blind faith but in recognizing resilience, innovation, and enduring growth potential. While headlines frequently emphasize negative news, history demonstrates that markets have repeatedly navigated turbulence and returned stronger.

Yet optimism faces constant tests. Let’s consider this year’s early challenges: a rapidly shifting policy landscape, market selloffs, and U.S. companies scrambling to adapt to tariff changes. Economists struggled to predict the economic impact while Wall Street analysts revised S&P 500 growth forecasts down and revived recession predictions. The mood was decidedly pessimistic.

Fast-forward just a few months: with summer mood at its peak, so too are investors, as the S&P 500 not only recovered but reached new all-time highs nearly every week.[1]

The lesson is clear: there is always something seemingly negative on the horizon. Since the 1930s, the S&P 500 has weathered 14 major selloffs — from the Great Depression to the COVID-19 pandemic. Yet over that same period, the index has delivered an annualized return of roughly 10%.

The constant appears to be crisis; the pattern is recovery. Investors who stayed the course were rewarded not for perfect timing, but for patience and discipline. [2]

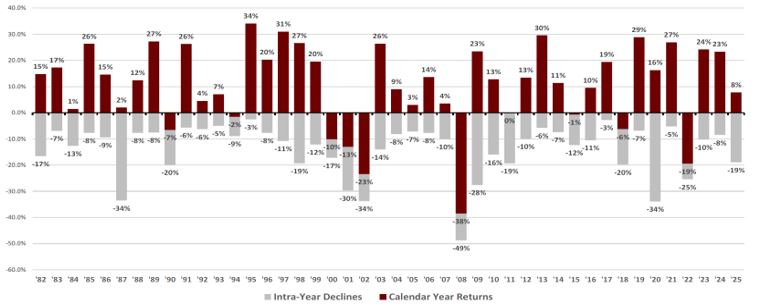

Volatility and corrections never feel pleasant, yet they are more the rule than the exception. Markets experience pullbacks every year — even in years of positive returns as seen in the chart below.[3]

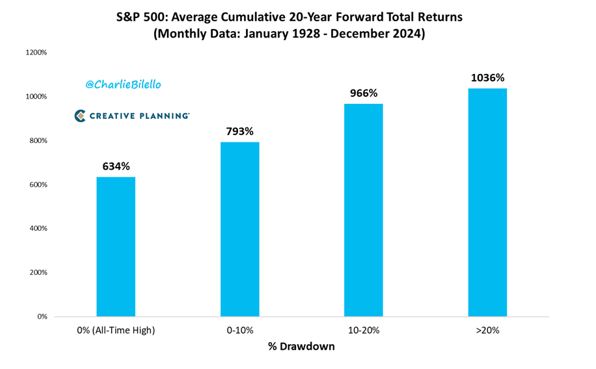

Historically, these corrections have presented opportunities rather than reasons to panic. The most attractive long-term returns have often followed the most difficult periods: 20-year forward returns are historically highest after declines exceeding 20%.[4]

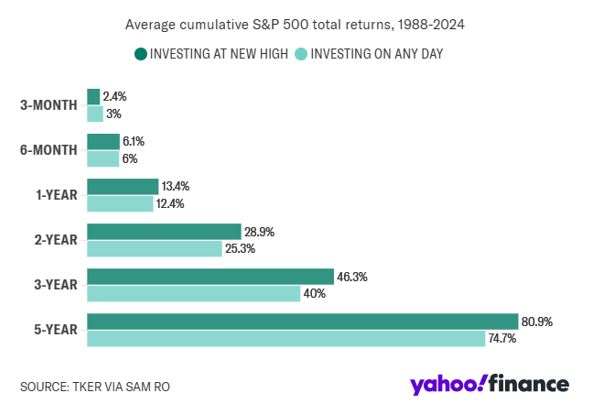

Even for those who miss buying opportunities during corrections, optimism offers a surprising advantage: investing at all-time highs is not necessarily “too late.” History shows that the S&P 500’s average returns following investments made at record highs have often exceeded those of the broader market over identical time horizons. [5]

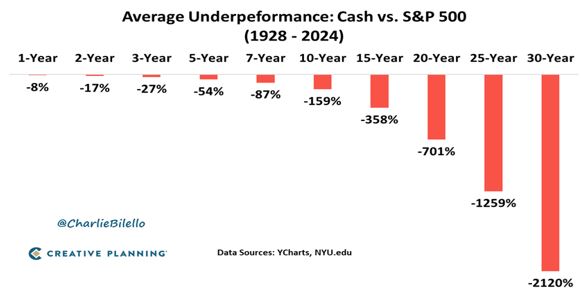

By contrast, perpetual pessimism carries its own price. Remaining in cash over long periods erodes purchasing power, as inflation quietly diminishes value. Meanwhile, equity markets have consistently outpaced cash by a wide margin over time.[6]

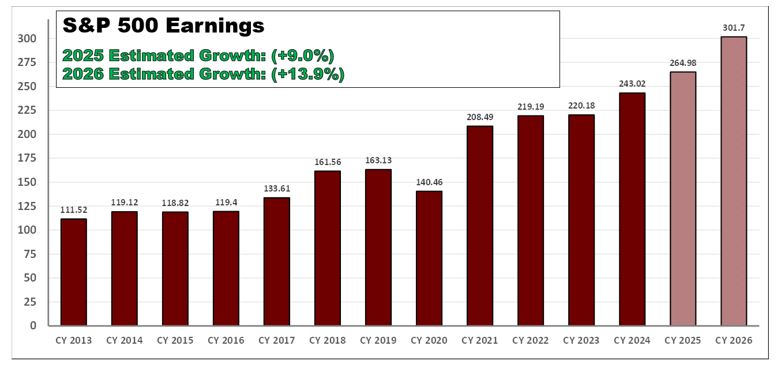

What drives the resilience and growth of equity markets over time? Fundamentally, it’s businesses’ ability to adapt, innovate, and sustain profit growth over the long term. As illustrated in the chart below,[7] corporate earnings are the driving force behind equity markets — and this engine has demonstrated remarkable durability through wars, recessions, and technological revolutions. Ultimately, innovation and adaptability fuel economic expansion and move markets forward.

While compelling cases can be made for pessimism, history shows that the most successful investors balance risk awareness with belief in growth potential. Being the one who invents the airplane, believing it will fly, rather than the one who builds the parachute, certain it will fall, proves the wiser long-term strategy. Optimism, grounded in patience and discipline, empowers investors to navigate uncertainty and capitalize on opportunities.

[1] https://www.wsj.com/livecoverage/stock-market-today-inflation-data-06-27-2025/card/historic-rebound-sends-s-p-500-to-new-highs-p4nfAnzqNestK5sEQPTH

[2] https://bilello.blog/2025/triumph-of-the-optimists

[3] FactSet as of 7/31/25. Returns are based on price index only and do not include dividends. Intra-year drops refers to the largest market drops from a peak to a trough during the year. For illustrative purposes only.

[4] https://bilello.blog/2025/triumph-of-the-optimists

[5] https://finance.yahoo.com/news/yahoo-finance-chartbook-35-charts-tell-the-story-of-markets-and-the-economy-midway-through-2025-080012747.html

[6] https://bilello.blog/2025/triumph-of-the-optimists

[7] FactSet as of 7/31/25