“TINA” is an acronym for “There Is No Alternative”, and the term has been used by investors over the last decade to describe the US stock market (S&P 500) compared to other asset classes (especially bonds). It was based on the strong returns of the S&P 500 against virtually all other asset classes. The current state of global markets has a new moniker – “TARA” or “There Are Reasonable Alternatives”.

As an example, for “TINA”, investors in search of income post the Great Financial Crisis in 2008-2009 had a challenging predicament based on the historically low interest rates for an extended period of time. There were a few options for them to select from:

- purchase bonds and receive very little in income, or

- invest in stocks that, all else equal, tends to increase the risk of a portfolio

Recently, this pendulum has begun to shift, and investors have the opportunity to achieve equal returns with lower risk and greater diversification. This shift has come as a result of the Federal Reserve raising rates aggressively over the last year and a half. While this was painful for existing bondholders (as prices fell), it created an attractive opportunity for new bond investors as well as earning interest on cash.

Adding to “TARA” is the increased prevalence and accessibility of alternative asset classes through exchange traded funds (ETFs). It is expected that assets under management for alternative investments is expected to grow from $10 trillion in 2020 to $17 trillion by 2025.1

Alternatives cover a broad range of assets, including:

- Gold and precious metals

- Commodities such as oil and wheat

- Real estate that includes buildings, land, and forests

- Infrastructure comprising toll roads and bridges

- Futures, options, and derivatives

- Debt of a private company or companies

- Royalties from land and music

- Art, wine and collectibles

Remember, the real use of bonds and alternatives is not necessarily to outperform equity markets, but rather to diversify and help protect assets while equity markets are falling. Protecting assets when markets are falling can be just as important as earning solid returns when markets are rising, especially as investors are using their investable assets to fund their lifestyle.

The cornerstone for using alternative assets is as a source of return that is not directly correlated to the stock market. This means when equity markets move in varying directions, the uncorrelated assets do not necessarily move in tandem.

There are varying degrees of correlation amongst asset classes.

- Low correlation means assets trend in the same direction but to a lesser extent

- No correlation means asset increases and decreases don’t tend to flow together at all

- Negative correlation means an asset will rise while the other falls

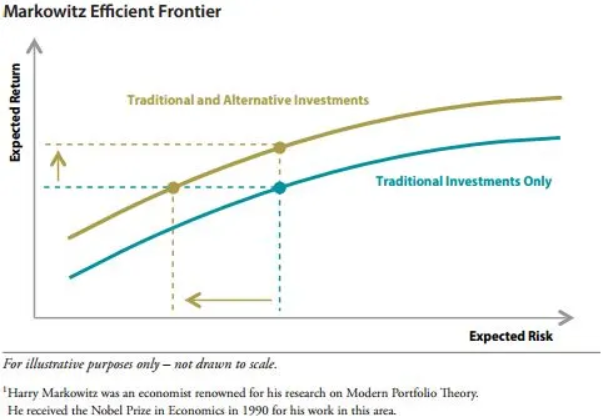

Buying alternative investments usually creates diversification benefits and, as a result, are able to lower volatility and provide a degree of downside protection when markets are not doing as well. The chart below2 shows the added efficiency of holding alternatives in a portfolio.

The goal for adding alternative assets:

- Similar long-term portfolio returns with less risk

- Greater long-term portfolio returns with equal risk

In summary, the term “There Are Reasonable Alternatives” seems to ring true given the current yields investors can get investing in bonds combined with greater selection of alternative asset solutions with lower correlations to the stock market. Diversifying an allocation with alternatives or fixed income can reduce the overall risk of the portfolio and Gradient Investments offers the Endowment Series with a number of risk models, which invests in stocks, bonds, and alternatives in different models to fit an investor’s risk tolerance.