By Lisa Schreiber

As we are entering the warmer months of the year, investors experienced some April-like weather in the stock market last month. Adding to the uncertainty, one of Wall Street’s most well-known seasonal sayings has resurfaced: “Sell in May and go away.” After a volatile April, that adage might feel especially relevant this year. Markets were shaken by policy changes, particularly tariff announcements, geopolitical tensions, and renewed concerns about slowing economic growth, [1] leaving many investors feeling uneasy heading into summer. With recent market swings still at the top of my mind, stepping to the sidelines may feel tempting. But does the data support that move, or is this more myth than strategy?

The “Sell in May” phenomenon is based on the historical observation that stock market performance tends to lag between May and October compared to the stronger November through April period. This idea gained popularity through the publication of the Stock Trader’s Almanac, and reemerges each year as investors search for predictable trends in an often-unpredictable market.

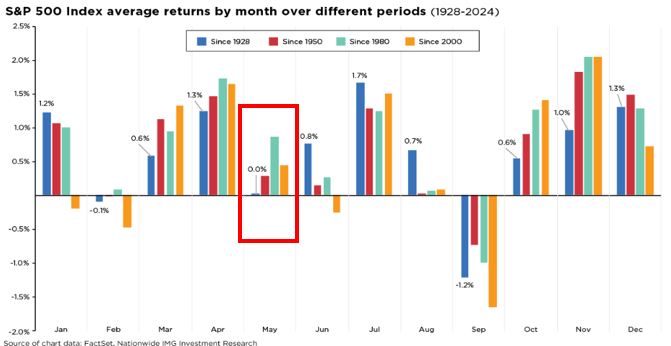

There is some truth to the observation – stock markets have historically delivered stronger returns from November to April. But that doesn’t mean the summer months are destined for negative performance. In fact, the average return for the S&P 500 in May, while lower than some other months, is still positive. [2]

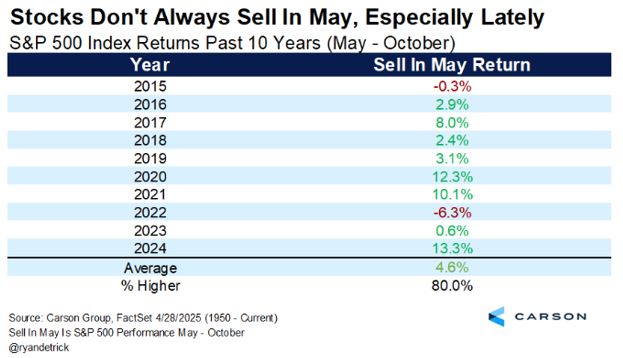

Looking more broadly at the May–October period, the S&P 500 has delivered an average return of about 4.6%, as shown in the table below. [1] That’s a meaningful potential gain to miss out on by exiting the market based solely on the calendar.

While seasonal patterns might explain some historical summer stock market softness, they shouldn’t drive investment decisions. Selling out and sitting on the sidelines until November could mean missing meaningful opportunities. The stock market is influenced by a wide range of complex factors – corporate earnings, economic data, interest rate shifts, global developments, and investor sentiment among them. While seasonal tendencies can offer interesting context, they should not be the basis for major portfolio decisions.

As the year progresses, staying focused on the broader economic picture – and your personal investment plan – remains crucial. Use seasonal sayings as interesting anecdotes, not guiding principles. While volatility from policy uncertainty may persist for the near future, staying invested and focused on long-term goals has historically been a far more reliable strategy than trying to time the market based on the calendar.

[1] https://finance.yahoo.com/news/stock-market-made-back-losses-124038060.html

[2] https://www.nationwide.com/financial-professionals/blog/markets-economy/articles/stock-market-seasonality-doesnt-have-to-be-destiny-for-investors

[3] https://www.carsongroup.com/insights/blog/why-we-think-you-shouldnt-sell-in-may/