By Kyle Bergacker

Geopolitical conflict has long influenced financial markets, but its impact today looks different than in the past. Rather than pushing the entire market higher or lower, geopolitical risk increasingly shows up as dispersion beneath the surface, meaning some sectors and regions benefit while others struggle. In this environment, leadership rotates, and capital flows shift toward areas seen as more resilient or strategically important.

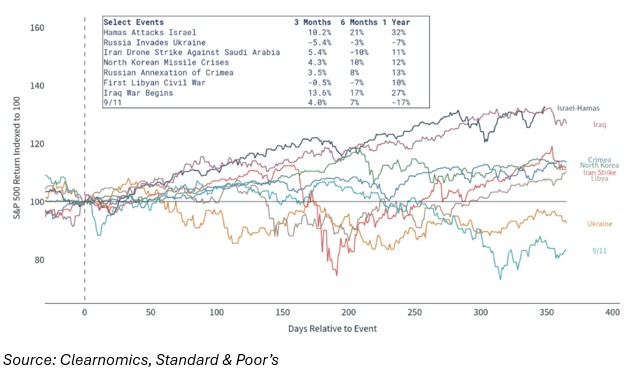

Market reporting from Reuters, the Associated Press, and others shows that equity markets still react quickly when geopolitical tensions rise. Stock indices often fall, volatility increases, and investors move toward traditional safe havens. However, these reactions are usually short-lived unless additional forces emerge to reinforce them. When conflicts persist without meaningfully changing the global growth outlook, markets tend to refocus on earnings, policy decisions, and financial conditions.

Institutional research supports this pattern. Studies from the IMF show that geopolitical shocks typically pressure stock prices at first, but those effects fade over time unless the conflict causes real economic damage. Academic research also finds that while geopolitical risk raises volatility in the short term, it often leads to clearer differences across sectors and countries over the medium term. In other words, markets begin to separate winners from losers rather than moving in one direction.

The Russia–Ukraine conflict offers a clear example. European markets initially sold off broadly, but performance quickly began to diverge. Energy exporters, defense companies, and firms linked to government spending outperformed, while energy-intensive industries lagged. Rather than creating a single market outcome, the conflict accelerated trends that were already underway.

Corporate behavior reflects this shift as well. Analysis from the Financial Times shows that companies are adjusting by redesigning supply chains, spreading production across regions, and placing greater emphasis on resilience rather than simply minimizing costs. These changes can weigh on profits in the short term, but they may lead to more stable earnings over time, an outcome markets increasingly reward.

Looking at the past 12 months, recent events have reinforced this theme. In 2025, reports of strikes involving Iran’s nuclear facilities, including Fordow, briefly pushed oil prices higher and pressured global equities as investors assessed heightened Middle East risk. Markets stabilized relatively quickly once it became clear that energy supply disruptions were limited. Similarly, renewed uncertainty around Venezuela that’s driven by sanctions, political instability, and shifting oil export expectations has led to modest, short-term moves in crude prices. The impact was most visible in energy stocks and Venezuelan-linked assets rather than across the broader market.

Importantly, geopolitical risk does not act in isolation. Its market impact depends heavily on the broader economic backdrop. When financial conditions are supportive and corporate balance sheets are strong, markets tend to absorb shocks more easily. When conditions are tighter, the same event can have a much larger effect. This helps explain why recent conflicts, despite their seriousness, have not derailed global equity markets.

Another notable development is how investors respond to these events. Markets now appear better at distinguishing between symbolic geopolitical headlines and those with real economic consequences. Not every escalation leads to lasting disruption. This filtering reduces the likelihood of panic, but it also increases dispersion, as investors more quickly reassess which sectors and companies are positioned to benefit, and which are not.

At Gradient Investments, we view geopolitical risk as a force that amplifies differentiation rather than drives uniform decline. It creates volatility but also opportunity. Sectors aligned with security, infrastructure, and strategic autonomy may benefit, while those dependent on stable globalization face challenges.

Looking ahead, geopolitical risk is likely to remain elevated. The investment challenge is not predicting the next conflict but understanding how markets reprice risk and where fundamentals ultimately assert themselves. In a fragmented world, dispersion, not direction, may be the defining market theme.