By Keith Gangl, CFA®

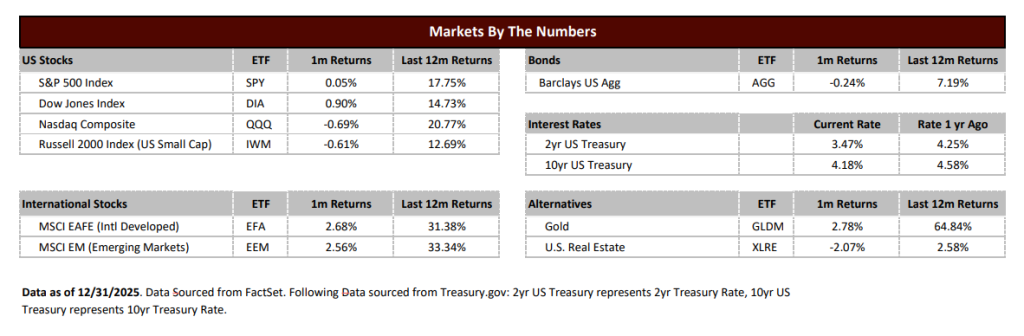

The stock market, measured by the S&P 500, finished near record highs, closing the year up 17.75%. The year 2025 marked the third consecutive year of double-digit gains for the S&P 500. Not only did the stock market post three years of strong returns, but the bond market also followed suit, with the Barclays US Aggregate Bond ETF finishing up over 7% in 2025.

Gradient Investments’ theme for 2025 of “bring an umbrella”, reflecting both investor optimism and concerns about market performance, proved prescient throughout the year. While markets finished near record highs, they certainly tested investors’ conviction with significant volatility and troubling headlines along the way.

The year 2025 was memorable not only for the robust returns in both stock and bond markets but also for numerous newsworthy events. These included “Liberation Day,” a new set of aggressive tariffs announced on April 2, a government shutdown, Federal Reserve interest rate cuts, and continued advances in artificial intelligence.

We believe that when investors look back a decade from now, the most memorable event of 2025 will be the dramatic increase in tariffs, even more so than the market’s impressive “three in a row” performance. The US effective tariff rate rose from 2.5% at the beginning of 2025 to above 15%[1] by year’s end. While some tariffs have recently been eased and we may have seen peak rates, the effective tariff rate remains several multiples higher than at the start of the year. Though tariffs generate revenue for the U.S. Treasury’s general fund, they also function as a tax on consumers and businesses, and their impact on the economy is still not fully known.

Our outlook for 2026 remains constructive, though investors should still carry that umbrella and prepare for potential market volatility and corrections that, while normal, can be uncomfortable. Gradient Investments will monitor several key metrics in 2026 to help determine the market’s future path: corporate earnings growth, interest rates, and unemployment rates. Corporate earnings are expected to grow 15%[2] nearly double the 10-year average of 8.6%.[3]

As we navigate the year ahead, the foundation for continued market strength appears solid, supported by healthy earnings expectations and a resilient economy. However, the elevated tariff environment and geopolitical uncertainties remind us that vigilance remains essential. At Gradient Investments, we remain committed to balancing optimism with prudence, seeking opportunities while managing risks on behalf of clients. The “three in a row” achievement reflects not just favorable market conditions, but the importance of staying invested through periods of uncertainty. As always, disciplined investment strategies and a long-term perspective will be our guides as we work to help clients achieve their financial goals in 2026 and beyond.