By Keith Gangl

April is one of the shortest months in the calendar year, yet the market volatility made it feel extraordinarily long. As we discussed over the last few months, we anticipated increased market volatility as markets reacted to rapidly changing economic headlines. President Trump’s declaration of “Liberation Day” on April 2 added more fuel to the fire.

Trump’s long-awaited tariff announcement was more aggressive than many expected. The administration announced that a 10% universal tariff would be applied to imports from all countries, with additional country-specific reciprocal tariffs layered on top. This announcement increased effective tariff rates overnight to levels not seen in the US in over 100 years, triggering an immediate negative market reaction.

In the days following the “Liberation Day” announcement, markets sold off aggressively as these large tariff increases raised uncertainty around business activity. The S&P 500 approached bear market territory (defined as a selloff of over 20% from recent highs) but managed to recover from the lows of April 7 to finish outside bear market territory. While the S&P 500 had peaked in February, after the new tariff announcement markets sold off by more than 10% in just one week.

Adding to the volatility, President Trump announced on April 9 a 90-day pause on all “reciprocal” tariffs. The market response was overwhelmingly positive, with the S&P 500 finishing up 9.5%, recovering most of the losses that occurred after the “Liberation Day” announcement. This one-day move of 9.5% was the third largest one-day gain since 2000 and ranks in the top 10 for all-time single-day moves for the S&P 500.

Volatility is not new to stock and bond markets, but the recent turbulence seems somewhat different from historical patterns. The current volatility is largely self-inflicted through tariff policy announcements, whereas traditionally, market disruptions have stemmed from external factors such as COVID-19 or the Great Financial Crisis. The good news is that if aggressive tariffs are causing market volatility, policy can be modified just as quickly as it was announced. We witnessed this potential on April 9 when the 90-day delay on reciprocal tariffs triggered one of the best trading days in market history.

Whether through agreements with trading partners on tariffs or market participants adjusting to the new reality, there will come a time when Washington is no longer center stage in the investment universe. However, this does not mean investor concerns will disappear, the focus will simply shift to other issues. A proper investment plan acknowledges uncertainty but makes changes based on prudence rather than emotion through both good and bad times.

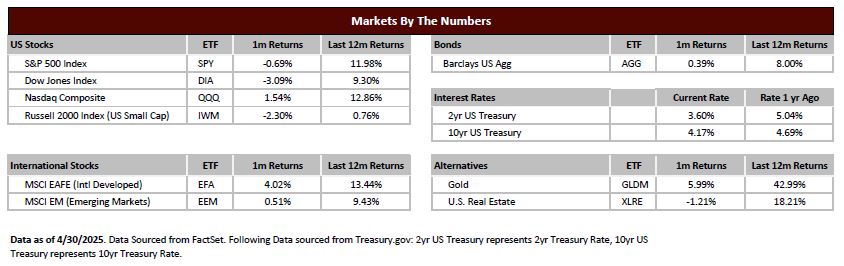

As volatile as the month has been, with large moves up and down in the stock market, many investors would be surprised that the S&P 500 finished nearly unchanged for the month, finishing down less than one percent. As we progressed through April, volatility began declining, and if this trend continues, it bodes well for market stability. If investors can tune out rapidly changing news headlines and focus on company fundamentals, they’ll find a story of a US economy that, while slowing, is still supported by resilient consumer spending. Nevertheless, consumer confidence can be fickle, and we will continue to monitor changes in consumer behavior closely.